37+ are mortgage payments tax deductible

As noted in general you can deduct the. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. Web For the 2019 tax season standard deductions are. Dont Leave Money On The Table with HR Block.

Web Mortgage insurance payments are tax deductible through 2021 but the deductions phase out if your adjusted gross income exceeds 100000 50000 for married people. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Its meant to protect the lender but. For married taxpayers filing separate returns the cap.

At HR Block You Can Get Help Online or In-Office. Signed in 2017 the Tax Cuts and Jobs Act TCJA changed individual income tax by lowering the. Web Mortgage Interest Tax Deduction Limit.

12200 for those who are single or married and filing separately 18350 for those filing as the head of the. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have been. Homeowners who are married but filing.

Web The Tax Cuts and Jobs Act TCJA which is in. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Ad Access Tax Forms.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Complete Edit or Print Tax Forms Instantly. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web What Payments Count Towards a Tax Deduction. How Much Can I Deduct.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. You must make a mortgage payment before the end of the calendar year if you want it to count for a. Web Private mortgage insurance is typically what you pay if you got a conventional home loan and put less than 20 down.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Get Your Max Refund Guaranteed. Web In most cases mortgage insurance payments are not tax deductible.

Web Is mortgage insurance tax-deductible. Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Ad Need Help Filing Your Tax Return. Generally it must be acquired to protect the lender from borrower default and is usually paid as a one-time.

Which States Benefit Most From The Home Mortgage Interest Deduction

Typical Mortgage Payment To Climb More Than 50 Bmo Economist R Canada

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Land Loans Everything Buyers Need To Know

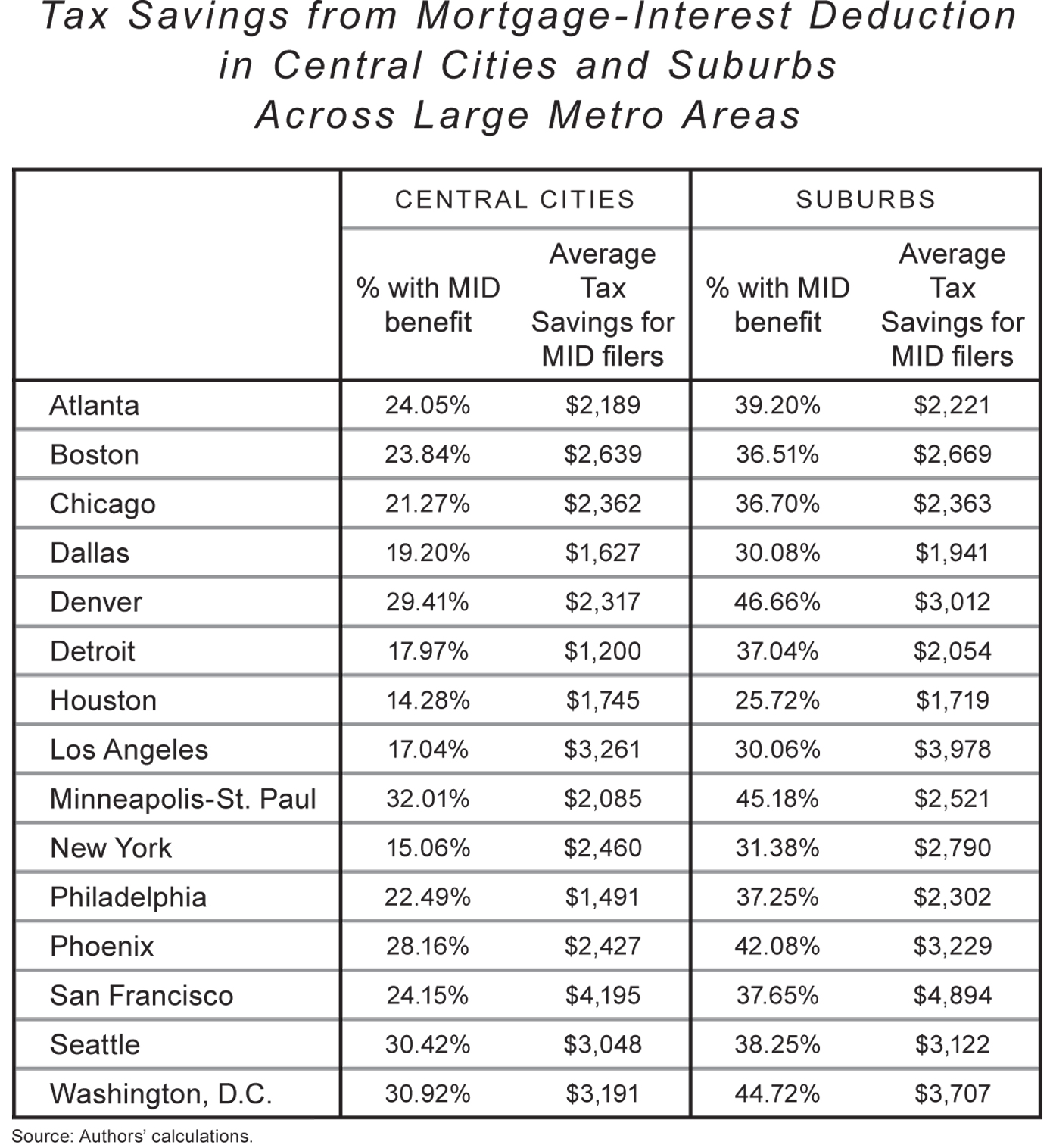

Rethinking Tax Benefits For Home Owners National Affairs

Are Mortgage Payments Tax Deductible Potential Deductions Explained

Tax Benefits Of Owning A Home

Mortgage Interest Deductions Tax Break Abn Amro

What Expenses Can Be Deducted From Capital Gains Tax

What Expenses Can Be Deducted From Capital Gains Tax

Nowly Insurance Review Loans Canada

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Vystar Credit Union Review High Interest Rates On Cds

What Expenses Can Be Deducted From Capital Gains Tax

Is Your Mortgage Considered An Expense For Rental Property

Taxes What Parts Of My House Payment Are Tax Deductible La Financial